Energy is a complex business that doesn't lend itself to sound bites. Nearly every day, one is exposed to statements that are misleading or just plain false. I call this B.U.L.L. (bombastic utterances of laughable lads). Below are some of the sound bites proffered by politicians and "talking heads" followed by a detailed explanation illuminating the truth as I see it. The statistics and figures presented come from reliable sources. Subject matter covered is as follows:

- "Oil Exports"

- Domestic Oil Production, Imports and Reserves

- Oil Production from Federal Lands

- Energy Independence

- Quick fix for gasoline prices

- Oil Company Subsidies

- Oil Company control of retail markets

- Oil Market Speculation

- "Dirty" Canadian oil

- Keystone XL pipeline

Editor's note: The following is an excerpt from a research paper recently completed.

Statement: We are exporting “oil” out of the United States

The U.S. Canada

Domestic refining is capable of processing in excess of 15 million barrels of crude oil per day. The industry imports about 9 million barrels per day of crude oil to supplement our 6 million barrels per day of domestic crude production. Prior to 2007, the U.S. U.S. America America

Source: EIA

Source: EIA

Statement: We are producing more oil in the U.S.

Domestic oil production peaked in 1970 at about 10 million barrels per day. Domestic production bottomed out at less than 5 million barrels per day in 2008. Higher prices and new “fracking” technology have increased domestic production to about 5.7 million barrels per day in 2011. The increased production is coming from state and private lands, not from federal lands subject to federal policy. Note that petroleum production actually declined on federal lands in 2011. In the short term, production from federal lands has been impacted by the Administration's glacial permitting process. See figures below for details. Longer term, Obama's decision to remove frontier areas of offshore California, offshore East Coast and most of offshore Alaska will impact production from federal lands for years to come.

Source: EIA

Petroleum Production includes crude, gas plant liquids and natural gas

Source: EIA

Statement: We are importing less oil in the U.S.

Domestic crude production has significantly increased since 2008 while domestic refinery runs have increased slightly. Therefore, it follows that imports of crude oil have declined since 2008 (see figure below)

Statement: Only 2% (22 billion barrels) of the World’s proved reserves reside in the U.S.

The statement is true but misleading. The Administration is implying that we are resource poor as far as oil is concerned. It is important to understand that “proved reserves” refer to the oil that is drilled for in existing fields. According to Department of Energy and Rand Corporation estimates “technically recoverable” reserves of 1.2 trillion barrels. This amount could supply the U.S for about 200 years without importing a drop of foreign oil. The definition of “technically recoverable” is that oil could be recovered from proven and existing technologies.

Statement: The U.S.

Can we ever produce enough domestic crude oil to feed our own domestic demand? As mentioned above, “technically recoverable” supplies could last 200 years if exploited. To be fair, some of these “technically recoverable” reserves are not profitable to produce at current prices with current technologies. Higher prices and/or new technologies would make “technically recoverable” profitable as well.

On the positive side of the equation, no one really knows how much oil lies beneath offshore Federal land or in ANWR because these areas are currently off limits to drilling. Some experts estimate that ANWR production alone could exceed 1 million barrels per day. The Government’s Bureau of Ocean Energy Management estimates Federal offshore reserves at 86 billion barrels (the equivalent of more than 4 Alaskan Prudhoe bay fields. At the peak, the North Slope fields produced over 2 million barrels per day)

So, the short answer is that we really don’t know for sure. We do know that the potential is very real. We also know that every incremental barrel of U.S. U.S.

Statement: There is little we can do to reduce gasoline prices in the short term.

I believe the statement is basically true. Releasing oil from the Strategic Petroleum Reserve (SPR ) could have a small short term impact.

The “SPR solution” would be short lived and in my opinion unwise for three reasons:

SPR oil should be used only in a critical emergency (high prices are not an emergency)SPR oil would have to be replaced at higher than its original purchase price- A release would have only a temporary and modest impact on world oil prices.

Longer term, energy policy drives crude oil and therefore gasoline prices. The Administration has taken several steps to curtail exploration in frontier areas and slow down both shallow and deep water drilling in the Gulf of Mexico .

- In early 2009, the Obama Administration rejected a Department of Interior plan to lease heretofore unexplored areas in offshore

Alaska California - In the aftermath of the Deepwater Horizon spill, the administration has curtailed permitting in both deep and shallow waters in the

Gulf of Mexico . - President Obama has delayed the Keystone XL pipeline which would have delivered 700,000+ barrels per day of crude oil from

Canada

In conclusion, the Administration’s actions speak much louder than its claims of impotence.

Statement: We should eliminate billions in “oil company subsidies”.

Looking at the “big picture”, Alan Simpson, former Senator and co-chair of the President’s Budget Commission stated that there are a trillion dollars per year in “tax preferences” (tax breaks that reduce tax revenue) in our tax code. I believe that the Code fosters an environment of corruption both legal and illegal. It encourages hoards of lobbyists to descend on Washington

According to and EIA (part of the Department of Energy) report entitled “Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2010”, total revenue losses attributable to provisions of the Federal tax laws for the Oil and Gas industry were pegged at $2.7 Billion. Of this amount over 90% is associated with accelerated write-offs of capital expenditures.

Referencing the same report, it is interesting to note that all energy specific subsidies in 2010 totaled about $52 billion. Renewables received about $20 billion of the total. Even though Oil and Gas accounts for over 60% of energy consumption in the U.S.

Source: EIA

Statement: Multinational Oil Companies control the price of crude oil

National Oil companies owned or controlled by sovereign foreign nations control 80% of the world’s reserves. Only about 10% of the world’s reserves are controlled by western multinationals. Don’t you think it would be difficult to control production and prices with 10% of the reserves?

Statement: Multinational Oil Companies control the street prices for gasoline and diesel.

About 5% of all gasoline stations/convenience stores are owned and operated by oil companies. The other 95% are either franchisees of oil companies or independent retailers. Franchisees and independent retailers set their own street price. The oil companies set the street price only on their owned and operated units. Do you think that a 5% market share can control street prices? I think not.

Statement: Speculators in the oil futures market are driving oil prices far above its “fair value”

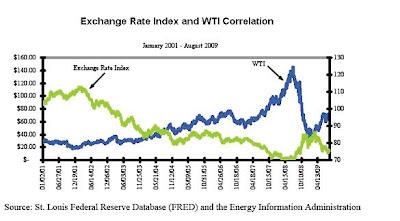

I have reviewed a great deal of research on the subject. There seems to be widespread agreement that futures prices are tethered to the realities of the physical market i.e. supply/demand spare capacity etc. Yet, there is a wide disparity of opinion regarding the impact of speculation and other factors. The CFTC does not believe that speculation is a factor. The St. Louis Federal Reserve thinks that 10-15% of the price of oil is driven by speculation. The James Baker Institute study sees a tight correlation between the value of the dollar and oil price (see figure below).

In my opinion, speculation and many other factors play only a secondary role in oil futures markets. However, Politicans make speculation an issue to deflect blame for their own disastrous energy policies. Watch for an upcoming blog entirely devoted to this subject.

In my opinion, speculation and many other factors play only a secondary role in oil futures markets. However, Politicans make speculation an issue to deflect blame for their own disastrous energy policies. Watch for an upcoming blog entirely devoted to this subject.

Statement: “Dirty” tar sands oil from Canada should not be produced. Therefore, Americans should oppose the construction of the Keystone XL pipeline.

Environmentalists have dubbed Canadian tar sands as “dirty oil”. This is a misnomer. It is true that extraction of this oil is achieved through different methods (strip mining for shallow deposits and steam flooding for deeper deposits) than extraction of conventional oil. It is true that carbon dioxide emissions resulting from the extraction processes are higher than those resulting from conventional extraction. It is true that the oil requires higher levels of refinery processing to yield similar amounts of gasoline and distillates than from light crude oils. However, tar sands “oil quality” is quite similar to some Venezuelan crude oils. Furthermore, the gasoline, distillates and other production made from these oils must meet the same specifications as products made from any other oil. Whatever one’s opinion, Canada has decided to move forward on the development of this resource. The economic incentives for Canada are massive.

Statement: The Keystone XL pipeline threatens a major aquifer in Nebraska and therefore should be stopped.

The application for permitting the Keystone XL pipeline was submitted in 2008. A 2010 assessment of the project by the Department of Energy stated that Keystone XL “would not appreciably increase” global life-cycle greenhouse gas emissions. The final Environmental Impact Statement completed by the State Department in August 2011 reached the same conclusion. After all of this, the State Department and the President stopped the project from moving forward, ostensibly because of concerns that the current route crosses an important aquifer. Didn’t State and the Administration know about the aquifer? There are about 55,000 miles of crude oil pipelines and about 95,000 miles of refined products pipelines in the U.S. alone. Do any of these pose the same threats to aquifers? There are already two major crude oil pipelines that traverse the aquifer and hundreds of miles of other lines in the aquifer area. Why is the Administration objecting if major crude pipelines already traverse the aquifer?

Disclaimer: Content, including research, tools and securities symbols, is for educational and informational purposes and should not be intended as a recommendation or solicitation to engage in any particular securities transaction or investment strategy. You alone are responsible for evaluating which securities and strategies better suit your financial situation and goals, risk profile, etc. The projections regarding the probability of investment outcomes are hypothetical and not guaranteed for accuracy or completeness. They do not reflect actual investment outcomes and are not guarantees of future results, and do not take into consideration commissions, margin interest and other costs that will impact investment outcomes. Content may be out of date or time-sensitive, and is subject to change or removal without notice

No comments:

Post a Comment